Benefits of

Motor Trade Insurance

Road Risk

Road risk cover for all motor trader businesses.

Traders Cover

Traders combined cover for your premises and business.

No Hassel

Insurance brokered from a wide range of insurers to remove the manual hassle for you.

Special Support

Specialist support and assistance from our dedicated motor trade team whenever you need it.

We cover

Motor Trade Insurance

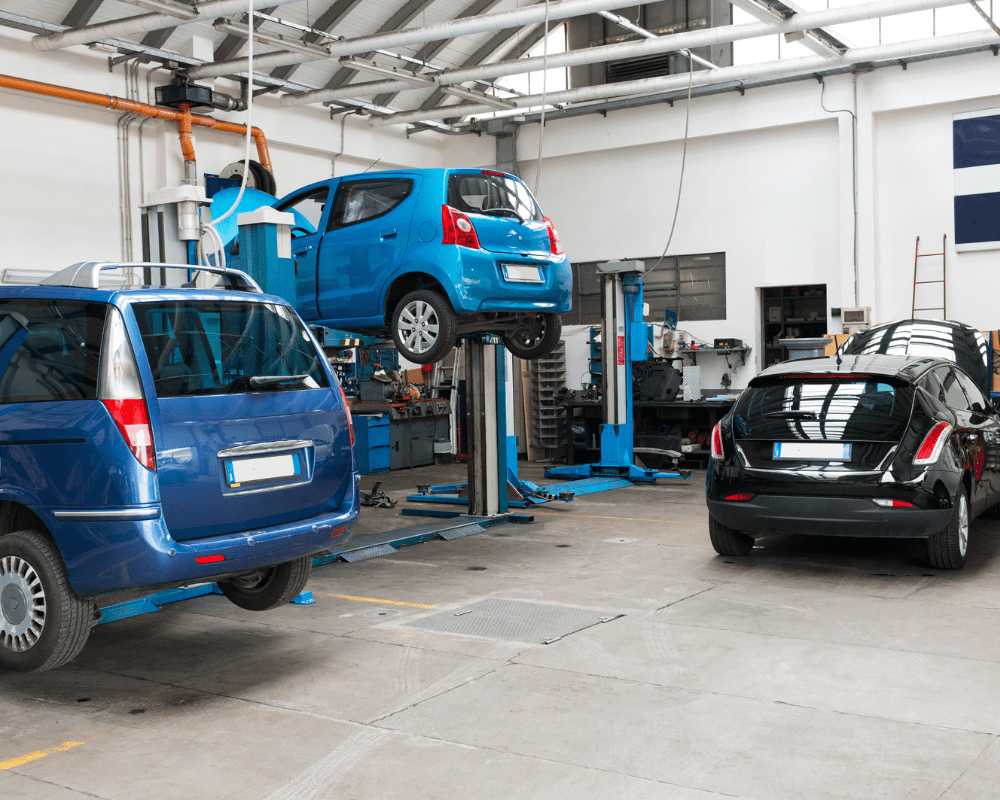

Motor trade insurance is a type of policy that provides a range of cover for businesses dealing with vehicles.

It’s essential to get a policy tailored to the specific needs and requirements of each individual or firm. The policies provide protection for customers’ vehicles as well as those owned by the business.

For example, car dealerships may need cover for their stock, and mechanics may need protection against any liabilities associated with working on customers’ cars.

Mobile mechanics will also require cover for the tools they carry around with them while attending jobs.

No matter what job you do within the motor trade, there is an insurance policy designed to meet your needs.

In addition to insurance cover for customer vehicles and your own, you can also opt for additional features such as emergency repairs and replacement parts, as well as legal expenses if something goes wrong at work or you’re taken to court over an incident involving a customer car. A great deal of flexibility is offered in terms of what kind of coverage you decide to take out.

It’s important to be aware that motor trade insurance isn’t just about covering yourself from potential damages caused by working on customer cars – it’s also about protecting yourself from other risks including theft and vandalism, public liability for accidents involving customers at your premises, and even damage caused by fire or natural disasters like flooding. By taking out the right motor trade policy you can ensure that whatever happens at work – whether it’s something within your control or not – you won’t be left vulnerable financially or legally should anything go wrong.